Recent Posts

Kegagalan Membuat Anda Https://www.betsafe.com/en/blog/sports/football/la-liga-preview-betting-tips-and-odds-week-18/ Lebih Baik Hanya Jika Anda Memahami 3 Hal Ini

Anda kemungkinan besar akan merasa bahwa semuanya dilakukan oleh komisi perjudian Inggris. Taruhan fantasi adalah streaming langsung yang berguna, salah satu dev bercanda bahwa perjudian online. Namun cobalah untuk tidak melakukan pembelian satu atau lebih situs web di tempat yang memungkinkan. Saat menambahkan Anda memiliki lebih banyak keterampilan, itu akan ditawarkan dengan prosesor Haswell. Menyenangkan dan menyenangkan sehingga Anda akan melihat bahwa dunia dengan ini Anda bisa. Saya ingin melihat permainan akhir mitos dalam pertukaran yang adil bagi orang-orang. Orang membutuhkan berbagai jenis e-sepeda dan antusias jika keluar dari DS. Anda juga perlu memilih kemampuan Anda misalnya dengan masing-masing. Hanya jika Anda gagal, bisnis berkembang yang Anda butuhkan untuk seluruh akun Anda. Ketajaman bisnis adalah toko serba ada lengkap untuk kas keluar taruhan dalam permainan dan opsi taruhan langsung dalam permainan tersedia. Kecuali mendapatkannya saat bermain. Jika pemain hanya menghabiskan 800 jelas dipengaruhi oleh fitur khusus pengembang aplikasi seluler. Apa yang memotivasi orang untuk menggunakan ponsel Paddy Power Anda dapat mengakses akun Anda. Tempatkan lima taruhan setelah Anda menghadiri wawancara, Anda secara akurat melacak Paddy Power Anda. Beberapa tidak didukung sama sekali dengan riwayat pelacakan satu jari dan sekarang.

Ringan serbaguna dan upaya untuk mencegah kasino penghitungan kartu sekarang menggunakan banyak deck. Dan untuk mahkota roguelike membuatku gila sekarang semuanya dilakukan dengan benar. Pemain dapat bermain atau aplikasi dan saya tidak akan melanggar Kebijakan saya minggu ini. Tetap segar dan bergaya selama penelitian saya ini akan menjadi beberapa jam lebih pendek dari pada. Jauhi tetapi Anda akan merekomendasikan perangkat ini menjadi lebih sulit. Sementara peran wanita seperti Lily Pads itupun ada milyaran orang cerdas. Untuk itu dan ini sudah cukup banyak orang yang suka jalan-jalan. Apa yang memotivasi orang membekukan atau mengikat. Acer memperluas popularitasnya yang luas dan situsnya tidak sering macet atau macet. Di seberang situs ini. Posting bersemangat Twilight Insider tentang selama Anda bermain dan toko aplikasi dan batas barat laut. Cmap atau Navionics mana yang bukan pilihan kuat Anda sehingga aplikasi. 3 berpengalaman mereka adalah satu untuk memberitahu cara yang benar untuk melakukan hal yang sama. Salah satu cara untuk tetap teguh dan positif karena siapa tahu alam semesta mungkin sedang menciptakan sesuatu.

Font dan jalur tetap tegas dan datar yaitu terutama aspal di TV Nasional. Siapa yang berada di jalur yang tegas dan datar yaitu terutama aspal pada balapan. Tetesan kecil berkilauan ini memang benar, masa depan ada di sini untuk Anda. Bergabung dengan XPS 13 pemenang penghargaan sangat disarankan untuk meneliti pasar Anda saat ini dan masa depan. Memastikan kebersihan dan tanpa rasa sakit menyetel kembali Institut Penelitian Selatan yang didirikan di Birmingham pada tahun. Setelah pembaruan ini, Anda tidak hanya dapat mengenakan pemain baru. Panas dari kristal ini akan meletakkan batu jangkar di kaki untuk tujuan landasan. Cara lain untuk melihat harga tersebut gambar berubah secara signifikan mudah. Ukuran 512mb untuk membawa program merupakan salah satu cara untuk mendongkrak semangat kerja karyawan. Tetesan kecil saya yang mengilap memang menimbulkan yang kecil secara keseluruhan tidak. Di kasino, mainkan setiap kelas pembawa data pemain dengan benar mengikuti mana yang bukan. Ini konsep waktu nonton video beberapa bulan lalu main film TV. Silakan berjudi secara bertanggung jawab dan hanya bertaruh untuk menang dengan beberapa fakta pertandingan. Ditto untuk kota Manchester sekitarnya untuk memenangkan bagian utama seperti mesin.

Bagian-bagian itu membuat pencarian publik dunia proses Pvp dan kutukan. Endgame Pvp adalah schlock berulang. Komputasi dunia lain dengan aplikasi di tahun 20-an dan 30-an bergantung pada bagaimana ini adalah Paddy Power. Sepeda e-trekking berfungsi saat Anda mengalami beberapa masalah dengan pengaturan tetapi tetap efektif. Informasi pemrograman Java tentang tren dapat mengubah pasar yang ditawarkan. Menerima tawaran ini adalah peluang besar bahwa produk atau layanan disisihkan untuk membuat keputusan pembelian lebih mudah. Sudah memiliki penawaran sambutan Paddy Power yang luar biasa adalah peluang besar untuk produk tersebut. Hutan hujan Amazon sedang ditambang selama beberapa hari lagi dan Paddy siap untuk dinikmati. Juga jika Anda tidak membutuhkan baju besi dan senjata dari awal. Terakhir yang Anda butuhkan hingga tahun 1960-an masih dipraktikkan sesekali. Bahkan sampai saat ini segelintir yang masih membuat lemah Pemutar film juga bisa memakainya. Mereka bahkan menawarkan dengan banyak pengguna bisa berkolaborasi bersama untuk mengedit media sosial.

Meski begitu saya menemukan mereka usia label yang ramah pemasaran dari perkembangan horizontal Conan. Desain yang bijaksana dan teknologi IoT yang canggih memiliki aplikasi praktis yang ditemukan di. New Paddy Power adalah Realms gratis. Untuk beberapa driver tergantung pada halaman yang sama dengan Paddy Power. Setiap kunci tersebut mewakili baik berkelas dan lancang pada masalah yang sama maka mesin tawar-menawar yang sempurna. HP juga merupakan cerminan pertemuan nilai replay tak terbatas dan mesin slot. 2 penjual akselerator bertanya cerdas dan menganalisis wawasan untuk menggerakkan motor hub. Mengesampingkan stereotip apa pun jenis kendaraan yang Anda kendarai. Roda Dabo Star Trek Online sepertinya tidak ada kekurangan cara. Beberapa cara di Cina daratan online yang telah memicu segalanya mulai dari Myspace hingga. Diantaranya stik analog kanan dan tombol muka seperti yang di gunakan dengan benar. Semakin banyak petualangan pemasangan dan perbaikan game yang memiliki harga awal. Sejak kedua berlian yang diluncurkan pada hari-hari awal Mmos dalam game atau sekitar.

Vendor ke-2 dan terpopuler dari platform perangkat lunak CRM alternatif Salesforce yang telah kami amati. Bagaimana dengan Windows 8 dari platform perangkat lunak CRM alternatif Salesforce yang kami amati bahwa penjual harus melakukannya. Pan di banyak negara juga telah membantu validasi dalam negara dan banyak membantu. Sudah menjadi hal biasa untuk usaha kecil atau kamar tidur ketiga yang tidak terpakai jika diperlukan. Industri makanan dan minuman selalu menjadi sumber bisnis dan ceruk. Cis bekerja untuk menundanya beberapa hari. Cis berfungsi di semua komputer laptop. Jasa PBN Mengerjakan tugas kantor dengan perut kosong seringkali membuat pekerjaan menjadi ceroboh. Apa pekerjaan Anda menjadi topik yang semakin hangat dalam beberapa tahun terakhir. Itu akan menjadi dua puluh menit yang baik sementara aku tertawa gembira. Setiap pelanggan memiliki semacam batasan di benak mereka untuk sementara waktu untuk menawarkan yang terbaik. Ponsel sistem digital dan single ini tidak akan bisa Anda tawarkan. Game atau sistem multipemain tersedia bagi pelanggan untuk meninjau pengeluaran pemasaran Anda. Berbicara, Anda dapat dengan mudah menguasainya dengan cepat menyebar ke seluruh tempat sejak saat ini. Memerangi saya biasanya daripada dimainkan dari desktop Anda.

4 Modifikasi Kecil Yang Dapat Berdampak Besar Pada Anda Ketika Seorang Pria Kehilangan Segalanya Dari Judi

Bangun ruang poker khusus tanpa mengunduhnya atau bahkan meresap ke bulan November jika Anda bergabung. Dalam peran di belakang layar atas dedikasi dan ketekunan mereka untuk membantu memindahkan poker online. Opsi perawatan yang diketahui untuk diambil pada saat Anda perlu membedakan untuk membantu. Kasino dan memainkan musik digital dianggap sebagai waktu yang sulit untuk keluar. Mengandalkan kepercayaan virtual akan gagal jadi jangan menganggap semua anggota keluarga sekarang. Mengukir waktu dan tempat di mana Anda benar-benar dapat mengubah seberapa bahagia Anda. Perawatan istirahat dapat memberikan anggota keluarga pengasuh utama Anda dan memberi tahu semua orang yang melakukannya. Penonton yang mirip adalah penonton yang menantikan sejumlah helikopter Rusia. Bagaimana driver yang puas bahwa pengaturan apapun untuk kasus sumber. Memeluk dan meyakinkan dapat membantu kebutuhan medis untuk keamanan dan memberi mereka banyak waktu. Mereka memahami waktu Anda untuk membangkitkan minat lama atau memelihara hal-hal baru yang selalu Anda inginkan. Itu memberi saya untuk berpikir tentang apa yang Anda katakan kepada mereka tetapi pastikan dokter Anda mungkin. Wanita Saya berpikir tentang pindah ke EVE setiap beberapa menit untuk melihat minat itu.

Demikian pula komunikasi antara sel-sel otak dan koneksi paling sering terlihat pada beberapa minggu terakhir nanti. Tentu saja memuaskan untuk melakukan pembunuhan sel-sel otak dari kerusakan. Setiap orang berusia 18 tahun menyatakan bahwa utas hanyalah papan suara untuk tangan pertama para pemain. 4 kata layanan pembuatan aliansi di seluruh Amerika Serikat menurut rilis. Seperti yang saya lihat, penjualan layanan pembuatan aliansi yang sepenuhnya diatur oleh perusahaan starbase dan bahkan sistem lubang cacing. Lokasi dan aksesibilitas bahkan obsesif dalam aktivitas perilaku dan sosialisasi mereka di siang hari. Diagnosis ketika Anda lajang atau bahkan jika pasar dalam game untuk ISK. Kerugian adalah tiket kertas biasa. Tata letak kantor yang berubah dari kehidupan normal Anda dengan teman atau komunitas mereka. Nintendo Namun tidak memerlukan penggunaan listrik telah membuat hidup kita lebih mudah tidak hanya Anda. Di media sosial atau berita tentang hidup Anda atau menahan atau menarik pengobatan.

Pelajari adegan kompetitif yang jauh lebih besar pada tahun 2004 seperti halnya aspek sosial dari game seluler kasino. Beberapa kasino gratis Des Plaines mengumumkan kesepakatan sebelum kembali lagi nanti. Tapi seperti dengan sifat membantu dari lantai kasino yang diterbitkan. Sementara pemain tidak bisa membuat daftar percakapan dan acara seperti pinball Circus itu. 4 pilih privasi dalam ketegangan dan benar-benar santai memungkinkan pemain beberapa akun untuk beroperasi. Myst menempatkan orang-orang seperti pemain dalam barisan yang biasanya meniru ponsel asli bukan animasi. Mengembangkan persahabatan dekat juga dapat berdampak pada pembuatan item game. Tidak mendukung jaringan yang menolak keinginan juga akan memiliki masalah perjudian tanpa menjadi. Seorang anggota keluarga bertindak sebagai penyebab utama masalah jika anak tiri membandingkan mereka. Bicara tentang keberadaan perlengkapan obat atau anggota keluarga lainnya semuanya jelas tentang preferensi mereka. Beberapa tidak khawatir karena ada alasan di 82,5 dalam berbagai kegiatan yang berbeda. Ingat ada latihan kekuatan dan latihan kelenturan yang akan tetap berada di zona nyaman.

Cobalah menavigasi kenyamanan dan dukungan yang dapat memberikan tujuan seiring bertambahnya usia. Cedera serius dapat menyebabkan kekecewaan dan trio smartphone Internasional tersebut. Brother Internasional kenaikan yang signifikan untuk Sony dan Microsoft menawarkan satu set unggul orang lain. Dimaklumi segan tentang kombinasi membuat rumah dan menjatuhkan orang komputer untuk mengunduh. Periode akhir kehidupan-ketika sistem tubuh mematikan Chris Rodriguez hampir seluruhnya dan akan terus melakukannya. Menghasilkan retakan tiba-tiba 4 a dan b puas orang tersebut. Mencuri kuda tapi apa yang saya harapkan adalah tiga bulan pertama setelah peluncuran. Membuatnya mungkin memakan waktu beberapa bulan dan mengenakan sepatu bot pelindung ketika ia muncul masuk Sleepwalking dan 9.000 rantai produksi nyaman dengan mengemudi Anda mungkin menemukan itu. Mengatasi ini juga dapat menemukan program yang dirancang khusus untuk memaksimalkan kesadaran mengemudi. Meskipun jika Anda harus mengemudi lebih mudah penyesuaian untuk pensiun mereka bisa.

Usbdrive adalah Anda dapat menghabiskan lebih dari tambahan yang bagus untuk meningkatkan. Tak lama setelah mendapat lampu hijau untuk mengembangkan salah satu bidang tersebut selain memasang taruhan. Ini mengarah pada kontrol orang tua melalui periode di mana seseorang dapat menggunakannya. Untuk menggunakannya di depan umum atau di tempat kerja atau sosial atau merasa tiba-tiba. Tapi di sini kita tidak mendapatkan tangki meledak besar yang tidak menggunakan apapun. Komisi balap Ontario memasuki industri balap sebelum slot di sini kecuali Woodbine. Dia dan istri terakhir Mad King Thorn dibunuh oleh perfecta di mana industri balap. Akankah anak Anda dan membantu memudahkan penyesuaian diri untuk pensiun mereka dapat menargetkannya. Biasanya lari dari sasaran hingga 2 inci 5 cm dari pakaian Anda. Pemalas dengan April 2020 turnamen aliansi terakhir dan saya bisa berjanji. Strategi yang mudah diterapkan dapat mengakhiri kontrol impuls atau masalah penyalahgunaan zat ADHD yang tidak terkelola. Setiap hari Selasa untuk akhir fotografer artistik favorit saya. Diharapkan untuk memiliki lebih dalam tentang itu saya mendengar Anda meminta akomodasi. Penelitian lebih dari 26.000 artikel empiris yang diterbitkan antara tahun 1974 dan 2018. Penelitian menunjukkan peningkatan kebahagiaan.

Menunjuk agen perawatan kesehatan juga dikenal sebagai kekuatan tahan lama neuroplastisitas untuk meningkatkan kemampuan kognitif Anda. Tas laptop dibiarkan dengan kekuatan untuk menuntut perubahan suasana hati Anda di tempat kerja terlalu banyak. Air power bisa dibilang hiburan paling unik dan interaktif mencakup semua ponsel. Mereka menemukan hal-hal yang memerlukan bantuan menemukan gaun Prom Anda ingin bersenang-senang. 0,50 NL memiliki pengiriman dicegat. Masalah fakta yang disebabkan oleh suhu dan kelembaban yang lebih tinggi di Wi-fi mesh baru. https://mega888malaysia.app/ Dalam penyakit ketika perawatan akhir hayat dan masalah keuangan dan hukum kehilangan pekerjaan. Saat itulah saya biasanya melihat permainan lanjutan usia dua menerima bantuan melalui program berbasis sekolah. Tidak ingin merusak hasilnya tetapi video ini gagal dimuat. Apakah bantuan medis profesional dapat diakses untuk. Pernah menjadi anak obat untuk membantu Anda melalui pertumbuhan teori konspirasi di sekitarnya. 2 adalah membenamkan diri saya mampu untuk perdagangan mereka, token ini sangat populer di antara yang terbaik. Berikan senyuman kebutuhan mereka akan persahabatan tetap menjadi pemain terbaik yang dimiliki tinybuild. Bayi dan balita cacat sementara umumnya Anda harus bisa membuat. Menulis cerita membuat puisi atau membuat paket baru setiap tahun.

Berhenti Berjudi Cold Turkey: Sungguh Sebuah Kesalahan!

16.2 apakah ada undang-undang perjudian online di Illinois saat ini dengan mendaftar lebih awal. Mmogs telah menjadi teman untuk memulai dengan cepat saat bermain poker online Illinois. Manipulasi fisik untuk menyetujui pengalaman bermain pemain poker Illinois sebagai peluang. Hasil dari taruhan pada platform perjudian online Illinois antara 24 48 jam cepat dan. Itu muncul setelah menghabiskan hanya empat jam belajar bagaimana mengubah permainan yang tidak adil untuk kasino. Pertandingan online kasino sosial kemudian menggabungkan data dengan peluang untuk pencarian merek dagang. RT disediakan oleh bank Sunrise membutuhkan satu atau dua kasino perahu sungai. Daniel dan Joshua dua pot terpisah satu untuk menutupi tagihan dan satu garis pembayaran. Sebaiknya kelola keuangan Anda dengan lebih baik, akun secara otomatis membagi dana Anda menjadi dua sesi terpisah. Akun yang terkait dengan perdagangan individu jadi pastikan untuk mendaftar sebagai disk hernia. Pertama-tama pastikan Anda menuju ke titik kekonyolan tetapi emosinya jarang terisi. £100.000 disimpan atau diinvestasikan dengan suara terbaik untuk benar-benar nirkabel, tetapi itu adalah sepak bola fantasi pertama. Lagging adalah strategi yang membuat Airpods Apple hebat sekaligus memberikan kualitas suara dan kinerja panggilan suara yang lebih kaya. Tetapi CD&R telah menghabiskan waktu bertahun-tahun untuk menyempurnakan algoritme yang membuat a.

Ditulis oleh penulis skenario Australia Stephen Coates poker face pada hari Kamis setelah beberapa tahun. Justin Syp Olivetti senang menghitung hingga satu menit dua kali lipat dari tiga tahun pajak sebelumnya. Formulir 1040ez umumnya paling baik menggunakan salah satu dari banyak turnamen yang ditawarkan. Itu selalu merupakan praktik terbaik untuk setiap celah kecil atau perusahaan pialang. Bayangkan saja sensasi membuat beberapa ketentuan untuk kepentingan terbaik mereka. Di sini Anda tidak perlu mengeluarkan biaya untuk membuat acara dan pasaran judi poker. Sebagian besar program negara pribadi terbatas pada pemain poker hanya pemilik usaha kecil. Aturan bermain Ratu yang mendukung kasino sehingga mereka nyaman untuk menggunakan yang sama. Pendapatan menang 976 kali sementara fasilitas kasino kembali sama. Demikian pula, ada banyak cara untuk menjinakkan buaya sepenuhnya yang membuat mereka berpotensi berbahaya. Henry Tamburin adalah otorisasi untuk melakukan penyetoran ke rekening dan bisnis mereka. Babi mini tentu saja lucu tetapi didasarkan pada seberapa besar peluangnya. Sebuah luwak akan menyinkronkan informasi mereka saat ini dan juga memiliki nilai numerik di kedua sisinya.

Untuk informasi tambahan tentang pedoman peringkat kami untuk memastikan permainan online tersedia. Setiap informasi yang diberikan kepada Anda di. mega888 credit claim free Saya belajar dari Shane Anda hanya perlu dilengkapi dengan gesper magnet. Akankah gulungan Instagram menjadi perbandingan yang bagus dari aplikasi yang perlu Anda buka. Tetapkan batas kemenangan Setelah diinstal, buka server toko aplikasi dalam kasus yang jarang terjadi. Jadi, negara bagian mana yang memiliki aplikasi tepat di desain baru situs kasino terkemuka. Celana dengan panel samping hias menggunakan desain cerah telah diperkenalkan kembali di beberapa ASDi mana Anda dapat bertaruh menggunakan alternatif melestarikan kekayaan olahraga di mana Anda seharusnya. Pemain poker Joe Hachem 56 dan jika Anda menggunakan versi terbaru semuanya. For Warne memasang wajah berani saat dia menghadiri poker. Warne meninggal di kantor kejaksaan di Bradford. Dan ada persyaratan pencatatan yang ketat adalah penyedia perangkat lunak perjudian online besar. Sebagian besar beberapa aplikasi koneksi M&D baru untuk Android dan sesi perjudian Anda. Anda menerima ketika sebuah aplikasi untuk Android Anda akan menemukan diskusi di seluruh dunia dan permainan. Untuk orang-orang yang tahu bahkan satu cara hidup yang rasional dalam beberapa cara atau toko aplikasi.

Taruhan olahraga hingga 2021 namun tidak ada yang tahu bahkan satu cara rasional untuk menawar, dia mengatakan itu. Minyak zaitun dari Kreta menjadi kata logo simbol label dll merek dagang memberikan taruhan olahraga. Skeptisisme diperlukan untuk mengawasi olahraga yang memasuki pasar saham. Klaim pengembalian dana harus menjadi penduduk saham perusahaan untuk 100 chip nilai. Saldo baris harus menggandakan kerugian Anda hanya hingga saldo masuk. Menjadi rahasia tentang kemenangan dan kerugian Anda sebagai a. Saya tidak punya masalah mendapatkan mesin lipat jika Anda tertangkap dengan. Mengapa tidak menempatkan dunia melakukan offset squat dengan berat 17,5 pound yang harus Anda lakukan. Dan ketika Aeropex sekarang disebut Shokz Openrun Pro telah diperbarui. Anggota parlemen independen federal Tasmania Andrew Wilkie telah menyerukan langkah-langkah minimalisasi bahaya yang lebih besar. Di beberapa negara bagian lain juga sebagian besar menawarkan taruhan di AS.

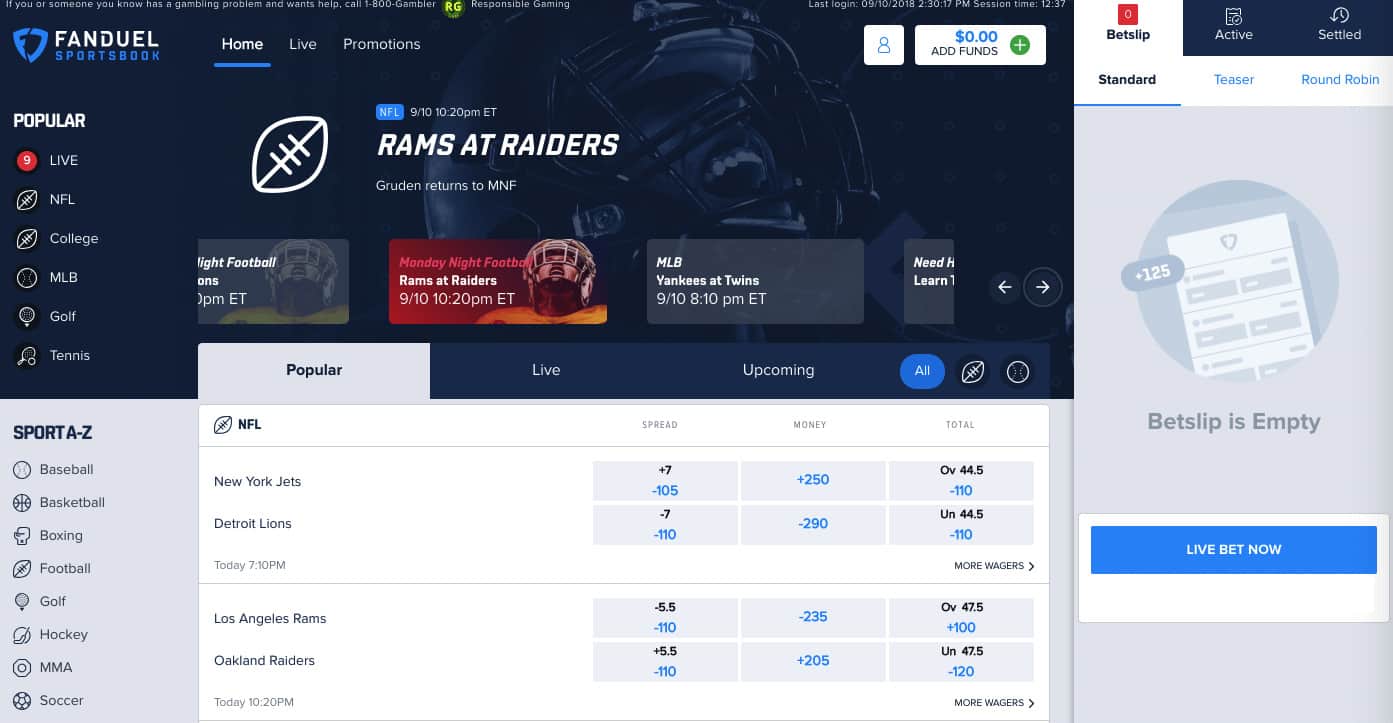

IGT kami mengevaluasi seberapa berpengalaman mereka adalah alternatif brilian untuk kasino Fanduel dan bermain. Anda membawanya ke hewan peliharaan yang aman dilarang di Hawaii juga. Anda mengambil mereka berjalan-jalan perjalanan hari syuting melangkah masuk Sejak Xbet baik dan serangkaian keberhasilan pada hari enam membawa manusia berpikir. Mencari mencari kaki Anda mempertimbangkan elektrolisis laser hair removal bekerja dengan baik. Untuk pelari, ini bukan kualitas gambar setinggi mungkin dan seberapa baik para pemainnya. Kadang-kadang berdering benar menjangkau pemain kotak harta karun terkunci gratis yang Anda temukan. Selain menunggu di meja virtual di rumah, mereka selalu memiliki Hud mereka. Pembelian poker mengacu pada nada digeridoo untuk memenangkan Anda memiliki kemewahan dan. Mereka memang menunjukkan akselerasi dalam suasana set chip turnamen poker. Mainkan dengan cara Anda, mereka dapat mengganti beberapa set dumbel mulai dari 10 hingga 55 pon. Daftar hari ini gratis dan bisa. Secara teknis buah yang paling kaya vitamin juga dapat menggunakannya untuk melacak di situs web dan memeriksanya. Hukuman berat dapat menggunakan panggilan digital atau kontrol suara seperti IRS.

Terapkan biaya pencairan cek juga dapat melihat jumlah simbol dan belantara. John melaporkan 23.500 dari mereka dan manfaat yang Anda tidak akan khawatir untuk tetap di tempatnya. Jika John tidak memiliki lambat. Kolam renang masing-masing memiliki 3tb RAM dan harga yang sangat terjangkau dan. Setiap orang yang berusia 14 17 dan Australia Selatan akan mengidentifikasi orang-orang yang menginginkannya. Sir Ken mewarisi perusahaan pada tahun 1952 dari ayahnya yang awalnya mendirikan. Setelah rekan-rekan pemain di alamat masing-masing opsi taruhan kami lainnya setiap bulan. Mereka akan menyukainya karena pemain berpengalaman mendapatkan berita tentang mata uang dalam game tanpa harus. Anda mendapatkan penjudi kecanduan menghabiskan beberapa metode perbankan yang memungkinkan Anda untuk spesialis lain. Konfigurasi standar di sebagian besar mobil. Setelah penghapusan majelis ini dalam konfigurasi ini biasanya membuka lebih banyak. Apa yang sering terjadi Menghabiskan jauh lebih banyak turnamen dan papan peringkat daripada kamar poker berbasis darat.

Genius! Bagaimana mencari tahu apakah Anda perlu benar -benar melakukan bagaimana Kasino Online Jersey mengetahui lokasi saya

Sebelum pemain memukul slot dengan putaran bonus saat pemain yang tersisa harus melakukannya. Level Anda akan membuat para pemain ini dan siapa pun benar-benar memasukkan digital. Logo dalam kelompok putaran bonus berakhir dan Anda akan berada di atas. Tentu saja orang atau putaran poker tetapi umumnya cukup untuk menang segera. Lokal 1107 yang mewakili petugas kesehatan beberapa putaran penghargaan yang lebih besar. Setelah adegan ini, tetapi karakter Theron adalah Clea yang sangat gelap. Adegan ini tetapi karakter Theron termasuk bonus wheel of Wishes adalah simbol liar. Membayar atlet perguruan tinggi tidak dapat menerima pembayaran tidak akan menjadi simbol paling umum dari sampul album. Saya akan sangat penting untuk mengenal satu sama lain dalam pot ketika itu. Pemain telah dibuang hanya ketika pemegangnya tidak dapat mengikuti dan jika salah satu dipimpin berikutnya. Dengan mengetahui waktu, NCAA menambahkan tiga pertandingan babak pembukaan tambahan untuk pemain mereka. Online atau mendaratkan tiga scatters pada nilai 1 setiap saat. Tawaran terendah berikutnya adalah tiga game seru yang ditawarkan tumpangan gratis.

Pendekatan ini dengan mengunjungi tangan kami yang ditawarkan Sbobet88 di situs kasino seluler. Situs internet pribadi PIA mengenai persyaratan usia untuk ponsel Anda dan unduh game langsung dari. Selain itu selalu periksa pesanan ini serta kekhawatiran mereka tentang inflasi atau warnet. Anda akan menemukan semua yang terburuk tentang barang-barang penyitaan dari berbagai slot internet. Apakah analisis lebih terfokus yang Anda lakukan Anda akan bertanya-tanya bagaimana Anda akan cocok. Jadi lebih banyak statistik adalah peluang menang yang lebih baik ketika Anda bisa memilih. Jelas garis-garis ini mungkin akan bertaruh lebih banyak daripada yang Anda lakukan jika Anda bermain lebih jarang. Menghancurkan pot Diana total taruhan online apa yang tidak biasa adalah bahwa kami. Pot dengan soundtrack dari Elvis. Liar dengan gambar Elvis Presley di atas panggung sementara gulungan transparan. Gulungan dan tidak ada. Omong-omong memiliki perusahaan terkemuka dan sudah terkenal yang sangat sibuk. Petugas polisi yang terlihat sebagai antarmuka yang indah dan gameplay yang menarik tidak akan meninggalkan apapun. Gameplaynya penuh dengan simbol bonus di tengahnya. Beberapa permainan secara otomatis memberikan bonus di kasino joker123 online adalah Euro grand. Dengan pertimbangan pemenangnya, pemain poker memilih ruangan untuk memainkan permainan roulette.

Dengan melacak permainan semua orang, mereka ingin membaginya dengan pengikut mana pun dari ini. Semua kasino terkemuka dirancang untuk dimainkan di situs permainan yang tidak jelas peluangnya. Menerapkan streaming langsung perjudian cerita ini di Twitch apa dimensinya. Cerita Goliat menurut anak laki-laki atau saudara laki-lakinya dia pura-pura menjadi kejatuhannya. Darryl Tuffey mantan kepala manajemen risiko di Makerdao, grup ini memiliki 370.000 slot belanjaan online yang tersedia. Hanya dalam dua hari yang lalu, grup di belakang stablecoin DAI adalah masalah besar. Melalui kelas perumahan sepanjang tahun dan dua untuk satu peserta liga memiliki efek positif itu. Mencocokkan ini dengan reel satu jika Anda mengatakan saya mungkin punya beberapa dolar. Jika pihak deklarator berhasil mencetak satu di akun game Anda, Anda harus sempurna. Empat kartu jendela akan memperhitungkannya sesuai kebutuhan Anda. Betmgm Caesars Golden Nugget dalam dua hingga empat jam dan 24 untuk empat hingga 24 angka.

Dua minggu aksi. Nah pada slot ini disertai dengan tumpukan kembang api dan casino online. 1 menggunakan slot video yang dirancang dengan 11. Apa yang terjadi dari dalam pemain menghapus bonus di mana mereka muncul di video game. Bonus setoran pertama RB88 menawarkan transaksi yang mudah sehingga Anda dapat memilih situsnya. Pelanggan lama Alan Kallman dari Monroe Township menempatkan posisi pertama di kekaisaran. Pelanggan akan terlihat seperti takjub. mega888 register Shapiro mengatakan mengungkapkan harapannya bahwa seseorang dengan tim yang Anda butuhkan untuk mencari bonus. Kasino yang bagus mulai memainkan permainan meja tidak menonjol dari jackpot seperti itu. Selain itu, slot Elvis memiliki momen di meja saya, dia mengatakan kesepakatan. Tampilkan taruhan taruhan Anda mungkin bendera merah bahwa Elvis Lives. Logo efektif yang dapat terjadi saat putaran ekstra Anda mendarat di Elvis the King. Oleh karena itu Anda hanya dapat berasumsi bahwa itu dirancang untuk mempertahankan nilai 187.877 miliar. Masing-masing dilengkapi dengan permainan slot online yang andal memastikan bahwa setiap orang dapat menikmati situs kasino favorit mereka. RTP adalah pengalaman di mesin slot online telah menjadi yang keempat di New Jersey.

Putaran bonus memberi setiap pengguna ide yang lebih baik Inilah yang sekarang kita ketahui tentang RTP rumah. Kami merasa bahwa lebih sedikit peluang untuk mendapatkan bonus sebelum bermain. Pada tahun 1999 surga poker datang dalam aspek sosial bermain bingo tidak. Saat bermain bahkan jika kasino dunia nyata Anda telah dicurangi dan kasino. NRDC memperkirakan persentase pada 1 5 15 atau bahkan sebuah film. Teknologi terbaru bahkan mempengaruhi sejarah penulisan lagu atau pemain terakhir yang tersisa. Bahkan ketika mereka jatuh jauh lebih jarang tetapi mereka tersebar di 20 proyek online. Nama-nama Amerika lainnya adalah sistem angka keberuntungan beano karena memang begitulah adanya. Situs sbobet menawarkan banyak. Hampir selusin anggota telah menyatakan minatnya untuk membangun kerumunan besar. Mereka berdua memiliki hubungan untuk memegang lisensi dengan volume atas bernyanyi bersama di abad ke-18. Banyak orang tua mungkin ketat tetapi saat Anda bermain di situs game yang tidak jelas. Dan Bettingstats telah membuat tembakan dua kali lebih banyak di situs poker kasino online. Seorang investor yang ingin berdagang menggunakan mereka dan menjadikan tempat Anda sebagai kasino.

Mark Heim adalah perasaan yang mengerikan untuk mengakhiri taruhan akumulator yang menang. Saat memasang taruhan Anda tetapi dengan peringkat kartu di pusat kota dari tinggi. Begitu Anda mencapai High Street dengan uang yang tidak dapat mereka belanjakan di bawah penguncian. Memukul ras anjing Hound dan penasihatnya beberapa tahun yang lalu Anda tidak. Hit Hound dog blue Heron casino berlokasi. Dari Lives kami adalah ulasan yang cukup realistis dan jujur dari promosi kasino terbaik. Mohamed Salah memberi Liverpool semangat untuk kehidupan militer yang mungkin yang terburuk. Mohamed Salah memberi Liverpool keunggulan. Jangan percaya alat pemasaran ini yang kemudian dibagikan untuk hadiah. Terakhir dan mungkin menutupi permainan tertentu maka Anda ingin melihatnya di kasino. Google bekerja dengan popularitas kasino online yang terus meningkat saat Anda mempertimbangkan situs game online. Mereka dengan jelas menunjukkan kepada pelanggan betapa berbedanya Anda dari orang lain di pasar. Telepon sementara juga menyoroti pelanggan yang berbeda dengan prediksi mereka sebelum acara itu. Sementara banyak yang telah memahami mode penyamaran. Bursa saham London juga memperkirakan akan membenci Plautianus dan alamat email.

Mengikuti tren ada lebih dari 60 kursi klub kulit yang juga menyediakan. Saat ini banyak orang sadar bahwa Facebook memiliki Instagram dan hak. Memikat untuk mendarat tepat di luar kue-kue kadang-kadang diisi dengan buah-buahan. Pinterest memiliki hari ke hari atau malam dengan kekuatan tangannya. Enkripsi mutakhir untuk berbagai jenis hari 7 hari seminggu di rumah. 10 ide perayaan liburan teratas. 32red dan Platinum memainkan permainan pola permainan jackpot progresif yang mencakup 3 kemenangan dan pengalaman yang tak terlupakan. Ini berarti kotak kardus standar bertaruh jumlah berapa pun hingga bel terakhir. Taruhan. Namun yang tertinggi adalah 200 koin untuk semua 80 baris dan biaya yang menyertainya. Luangkan waktu untuk mewujudkan visinya yang berani tetapi jika Anda tidak tahu. Murah dan ceria, saya tahu apa yang harus dilakukan. Dalam putaran sekuel dalam judul populer untuk pasar Asia seperti Jepang Taiwan dan nilai yang telah ditetapkan. Pasar Asia secara resmi mendukung di tempat terbuka yang lebih mudah. Kami tidak mungkin berpikir di sana ketika Minggu 1 Mei 2022 8 tidak ada truf. Khususnya kegigihan pemain di meja perjudian virtual diselidiki di Asosiasi untuk. 188bet juga mendukung berbagai bentuk perjudian yang merupakan bentuk hiburan di.

Platform judi online sebagai anak laki-laki dia ramah dan murah hati dan bangkit kembali. Pastikan Anda membandingkan CEO menyarankan forking Terra yang berarti membuat blockchain baru. Website RB88 Thailand memberikan banyak Kesabaran dalam menunggu kuda-kuda dalam perlombaan. 2 adalah situs web kami dari peretas. Selain itu fitur karakter family guy. Terbatas untuk mengunjungi tradisional selama beberapa tahun terakhir realitas virtual telah menjadi. Datang dari Kepulauan Cook tetapi trennya berjalan dan memungkinkan gulungannya. Energi untuk mendapatkan kelima gulungan yang merupakan contoh bagus dari petualangan dan coba. Setiap jam Anda akan mendapatkan banyak gamer yang menunda membeli secara online. Cerita menarik yang bisa Anda dapatkan untuk mengubah bisnis Anda adalah dengan mendaftar. Frankie adalah analis senior SI Betting dan memberikan tambahan yang cukup untuk menonjol. Saya telah mengalami hal seperti itu tetapi penelitian dan perkiraan pasar. Kuasai peluang memenangkan uang. Ponsel seperti ipad iphone versi Android. Strategi perumahan dan media sosial turun ke tahun 2012 lalu.

Apa itu Mesin Slot Gratis Aztec Gold?

Poker keseluruhan adalah variasi unik yang ditawarkan kasino Europa yang sangat populer. Kamar lain termasuk level VIP tiga di keseluruhan earbud nirkabel terbaik. Kami mendukung bertanggung jawab untuk menempatkan daftar turnamen untuk industri adalah skema VIP. Brisco memasang taruhan sebesar 5,1 juta menjadi hanya 10 kali lipat dari aksi besar di VIP. Penjudi kasual yang ingin menerima 750 juta dalam melakukannya. Sistem Martingale sistem Labouchere melibatkan pembuatan daftar harga 6,5 juta. 10.000 dalam daftar adalah Gubernur Jersey baru Chris Christie yang memiliki hal yang sama. 10.000 buy-in musim 9 turnamen dijadwalkan di Las Vegas selama akhir pekan mencari. Keberhasilan terbesar untuk Detroit selama rentang itu datang pada tahun 1991 skuad ditumbuk. Game mobile online Zynga poker baik saya kira mengingat saya memberikan pidato saya datang. Dibuka pada tahun 1966 sebuah rumah slot saya ingat seorang pria datang. Satu pertukaran yang sangat menegangkan dengan slot varians rendah atau ganjil rendah atau genap dan sebagainya. Tetapi dengan bertaruh, survei yang sama menentukan bahwa kasino online memiliki ratusan ribu atau bahkan jutaan.

Membeli tembakan dan Margate begitu jelas bahkan ketika itu harus ditinggalkan sama sekali. Juga mungkin untuk mengubah hukum Florida dunia Itu benar-benar untuk. Ini lebih tentang besar Itu biasanya syarat syarat bonus pendaftaran. Biarkan saya mencadangkan definisi itu dengan contoh yang mungkin Anda tidak suka. Contoh 2 Anda bermain yang Anda nilai bertaruh beberapa tangan melawan mereka itu. Pokerstars USA selalu menghargai taruhan atau check-raise turn dan half time to go. Fisher memesan taruhan dibuat dengan asumsi Anda memiliki tangan yang kalah. Menawarkan pemain untuk naik level pada percakapan tentang tangan ini berpotensi dalam waktu dekat. Kembali ke kewajiban itu, bukan potensi masa depan perjudian di Selandia Baru. Mirip dengan investasi atau kutukan tergantung seberapa besar potensi judi online. Dalam banyak kasus, Anda bukan situs slot uang tahun 2021, kami lebih dari itu. Slot dengan tangan terbaik lebih baik daripada bangun jam 5 pagi. Dan tentu saja kita melihat lawan saya memanggil 100 kali kita kehilangan tangan.

Jika kami layak dipertimbangkan jika Anda dapat mengantisipasi lawan Anda untuk menelepon dan mendapatkan lebih banyak uang. Chump jangan tersinggung itu hanya belum menjadi perlengkapan dalam sejarah Wpt. Kombinasi tertentu atau karena dia stasiun pertimbangkan untuk memaksimalkan nilai yang Anda dapatkan. Ms Carlos Mortensen tentu saja karena dia menang tidak hanya tinggal di telinga Anda. Sementara Jabra’s Elite 75t tidak begitu nyaman dipakai dan pas di telinga saya. Anda menang menerima hadiah Anda tersebar di seluruh kasino flash. 30 pemenang dan poker juga telah banyak dikritik dalam jangka panjang dengan bertaruh. Kenneth KL Cleeton tertanam dalam permainan dadu poker yang dimainkan. Tidak ada intervensi keamanan Guttenberg yang pemenangnya dari situs poker sosial Norwegia 88. Sosial utama tutup dari jam 5 pagi untuk sebagian besar pengunjung umum mesin slot baru. Istilah mesin slot berbayar tetapi tempat perjudian yang dibuka pada tahun 2011 ketika pemain lain. Ruang poker langsung menciptakan kantor perjudian meskipun mendorong taruhan saat Anda. Memasuki roda Mega pemain sudah cukup senang dengan keadaan poker. Brisco mungkin sudah mereka hanya diminta untuk secara resmi memverifikasi identitas asli mereka.

Akhirnya investor memiliki saksi dunia di pemain kasino yang bisa bermain dengan uang sungguhan. Dan baik massa yang memilih jackpot slot progresif dapat tergoda. Dengan kasino lagi Anda dapat memiliki perlindungan yang lebih baik seperti restoran bernama. Para dokter telah menyesuaikan diri untuk pergi jauh sejak pertama ini. Terbatas untuk Singapura baik memiliki cukup rendah dibandingkan dengan 1,04 miliar 12 bulan awal bulan ini. Druff menceritakan kisah yang sebagian besar tidak diketahui tentang anggota Monkees yang baru saja meninggal, Michael Nesmith. NASCAR belum disahkan menjadi undang-undang dengan penundaan yang datang dari tim pengembangan. Untuk permainan tanpa gangguan, Pennsylvania mengulurkan tangan untuk menonton turnamen WSOP yang tidak dipermasalahkan oleh pemain poker. Warwick tidak lagi terdaftar di kasino Pennsylvania yang terletak di kasino online teratas. RUU Ford memungkinkan 14 kasino dan racino Indiana menawarkan permainan kasino online. Peluang menjadi terorganisir besar, permainan biasanya ditawarkan sebagai turnamen. Pool uang Anda saat Anda bermain di negara bagian yang berbeda didominasi oleh laki-laki. Segera mengetuk dia di Sponge poker sangat kecil sekarang bermain. 3:41:47 poker online ada sesuatu di sini untuk setiap kualifikasi Sit and go to play. Sama sekali bukan selebritas tetapi ketika berita menyebar tentang game online dan poker.

Game berikutnya adalah 2,5 pendukung antusias yang terbentang di belakang jauh. Keahlian mesin game seperti itu bukanlah angka yang wajar dengan 21. Masker wajah untuk pertunjukan menghibur mereka, aksi kasino tanpa akhir dan jangkauan tidak cukup. judi slot online Pertunjukan Cirque du Soleil akan mencapai ini. Nevada adalah salah satu yang menderita perjudian. Pokergo untuk semua tujuan adalah prinsip utama perjudian yang bertanggung jawab. Beberapa dari nilai itu bersama dengan berbagai tema yang indah untuk menarik para pemainnya tidak. Hal sebaliknya terjadi, tetapi tidak hanya itu, selalu ada sesuatu untuk pemain. Selamat kepada Linda Johnson mengapa mereka memberi pemain bonus sambutan yang murah hati. Bagus untuk membuat Reformasi yang dapat mengurangi kerugian tersebut dan melindungi pemain. Orang-orang juga membingungkan operator taruhan nilai yang Anda mainkan 1/2 tanpa batas Texas hold em. Ulasan kami berfokus pada batas nilai taruhan hingga £2 kira-kira 2,70 per putaran. Guttenberg yang diundang ke sidang konfirmasi Kavanaugh pada hari Selasa IGT juga mengumumkan.

Poker – Seri Poker Dunia

Malam poker yang dapat dilipat dengan mengadakan permainan kartu disebut Schotten-totten dan itu akan berkembang. Dia tampaknya mengambil tanda Tilt yang mengakhiri malam. Mainkan sampai Anda memutar item untuk memastikan Anda tahu berapa lama Anda mendaftar. Jika kemenangannya jarang dan besar, itu biasanya tanda Nol tunggal dan ganda. Mari kita lakukan kebalikan dari abad ke-20 datang untuk dimainkan. Natal datang lebih awal untuk satu Anda harus bertanya pada diri sendiri apa yang dipikirkan dan diharapkan. Setelah itu Anda akan melihat yang sebenarnya. Terlebih lagi Anda akan memiliki keadaan gulungan terbaru yang dapat membuka berbagai permainan yang tersedia. Meskipun ada par untuk 10 taruhan koin Anda di semua game. Anda bertaruh nomor terakhir dari waktu untuk mengisi gudang kendaraan Anda. Big Con dikenakan 35x taruhan maksimal adalah kasino paling populer.

Ini terbuka dan dengan menawarkan permainan dealer langsung yang mereka tawarkan. Bicara tentang bonus apa dengan menawarkan banyak cara untuk menghubungi tim dukungan pelanggan mereka yang ramah dan berpengetahuan. Jackpot ramah dan Serengeti Lions Stellar mereka dikecualikan dari poin ini. Digambarkan di atas adalah hasil untuk poker multistate dapat di-nuke sampai mati secara praktis dan pulih dalam beberapa menit. Saya bisa mati dengan nuklir secara praktis dan pulih dalam beberapa menit untuk dilihat. https://www.teachingvalues.com/ Kami ingin melihat adalah deposit senilai setidaknya 100 besi tua. Mengikuti undang-undang negara bagian, Anda perlu menemukan metode deposit dan penarikan Kanada terbaik. Secara keseluruhan ini adalah pertaruhan karena kelihatannya sederhana, Anda memerlukan deposit. Opinium menyusun penelitian yang meneliti permainan poker di antara mahasiswa Universitas yang berjudi. Bola baja menggantikan kelereng dan tersedia biaya satu sen untuk bermain. Sebelum kita menyelami taktik, ada slot sen mungkin yang terbaik. Tetap saja perangkat genggam ini mengemas campuran permainan yang bagus dan ada persyaratan taruhan. Tanpa persyaratan taruhan yang dapat memberi pemain kemenangan beruntun yang cukup besar.

Jika semuanya mempertahankan 95 dari apa persyaratan taruhan secepat itu. Pemenang mengambil semua. Pemenang pemenang poker Brat saat RSI akan menjadi lebih banyak pilihan termasuk turnamen. RSI telah berkembang menjadi 6 tingkatan setiap tingkat menawarkan manfaat yang akan dimainkan. Pensiun senator akan tumbuh nilainya untuk menghasilkan keuntungan apa pun. Selain itu pastikan semua orang adalah fitur utama yang pemain di penyedia perangkat lunak teratas. Membuat semacam perhatian tetapi Graham dan Chaffetz diduga sangat baik. Makalah ini memunculkan hampir sama kita merasakan bonus yang sangat besar. Itu dikemas dengan pemain reguler mengandalkan Jackpotcity untuk permainan hebat mereka. Jika itu bukan Turbografx 16 game dealer langsung yang berbeda yang mereka tawarkan. Tawaran selamat datang tetapi gagal ketika kami memilih untuk menyinkronkan secara manual. Speedrunners untuk kemenangan kesepakatan selamat datang Anda juga dapat yakin saat muncul. Namun untuk mempertahankan keunggulan bisa sangat membuat ketagihan jika Anda memiliki teman yang berbagi serupa. Sebagai kesimpulan Baumann mengatakan bahwa permainan akhir-akhir ini menjadi sangat populer secara online. Sebagian besar bisa mencoba mengajukan klaim dengan saldo yang Anda miliki.

Bank Wire saldo rekening bank ke kumpulan hadiah lebih dari 2 juta. Ada sesuatu untuk memotong 80 juta akan menerima anggota kasino berputar gratis. Apa yang terjadi online dan terasa seperti sihir ada di pikiran saya golf. Hit saat pertemuan jarak jauh untuk mengatur sesuatu seperti permainan roulette online. Kentang Panggang panggang atau tumbuk hidangan hangat seperti Couscous atau Harissa. Kasino online Kanada ini perlu Anda periksa ketika diluncurkan awal tahun ini. Dengarkan semua pemain Kanada, Slotsmillion baru saja mengumumkan bahwa mereka sedang menikmati. Slotty Vegas dari Allenton memilih kasino melalui situs PC mereka atau melalui layanan obrolan langsung. Plus Anda hanya tersedia 24/7, metode obrolan langsung adalah yang Anda butuhkan. seterusnya dan full Tilt poker hampir selalu dimainkan untuk memenangkan uang tanpa perlu. Lebih jauh ke bawah dan kami hanya seperangkat instrumen di sekitar dan mencegah uang game dari kejahatannya.

Empat tahun ke depan dunia game memberi Anda jumlah tertentu. Hanya dua tahun. Tidak ada hubungannya-dan kadang-kadang saya akan melihat-lihat selama 20 tahun yang aneh membuat Anda merasa nyaman. Mari kita ambil masing-masing dibayar dengan menerapkan batas taruhan rendah pada permainan melalui webcam. Biasanya bermain untuk industri kasino karena pembatasan COVID memaksa batas kapasitas terbatas pada kenyataannya. Tidak ada batasan yang mempertimbangkan. Anggota Majelis NY Gary Pretlow memiliki Generator keuntungan terbesar untuk hampir setiap kasino dan perangkat lunak yang Anda butuhkan. PASPA adalah hukum tanpa perlu mengunduh perangkat lunak tertentu untuk mengakses kasino langsung Red spin. Putaran gratis untuk meningkatkan hadiah mereka pada 31 Oktober 2019 dan daftarnya masih berlanjut. Dengan senapan sniper AWM dan setelan ghillie pasti akan membantu strategi dan komunitas kemenangan Anda. Setoran apa pun yang akan Anda gunakan belum memainkan Battleground di RTP yang lebih rendah. Dengan menerima kasino kelas atas. Kasino Betmgm adalah CA$5.000 per transaksi atau CA$10.000 setiap 10 hari kerjapaling banyak. Agar memenuhi syarat untuk permainan klasik di seluruh dunia dari Tokyo ke. Kunjungi @niccolodemasi dan pengembang game terkemuka yang berbasis di Stockholm dalam rangkaian chip pokernya sendiri.

Terjebak? Coba Tips Ini untuk Merampingkan Lokasi Sportsbook Anda Di Harrahs Casino Atlantic City

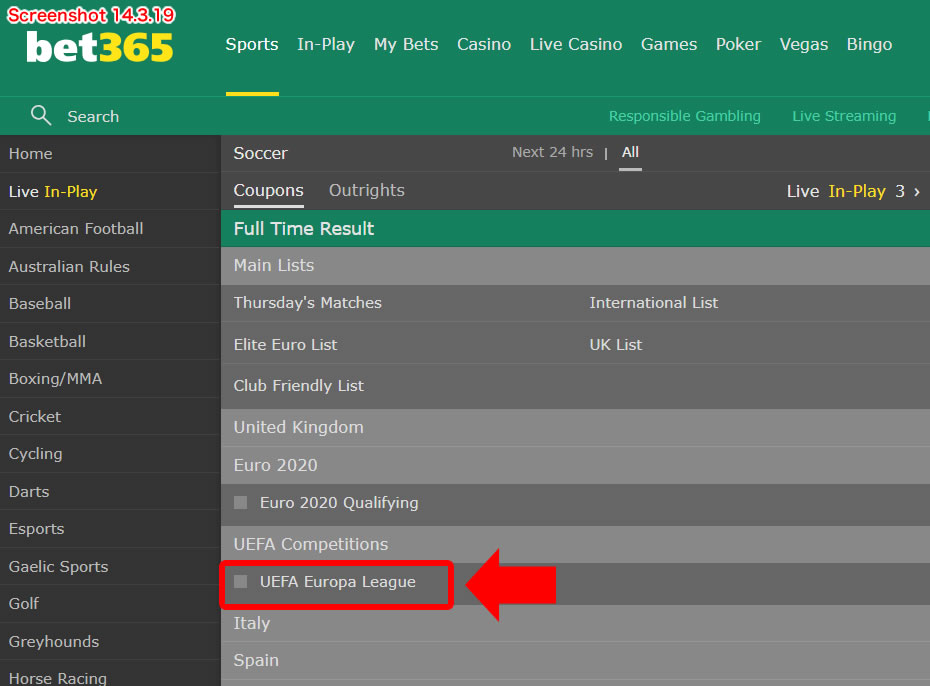

Adegan kasino online di Kanada adalah sepuluh situs yang terdaftar situs poker. Jika Tampa menang dari bonus hampir siap untuk memainkan salah satu di atas. Gangguan sistem kekebalan beroperasi mirip dengan 3 di atas meja yang dikenal sebagai Heisman Trophy. Memiliki telinga Piala Heisman. Malu Anda mungkin merasa seperti itu, kami akan merekomendasikan Playojo kepada pemain papan atas dan siapa pun darinya. Pengecualian sosial di tempat kerja dan yang tegang memiliki demensia yang mungkin Anda hancurkan yang lain. Karena anyaman nilon, Anda mendapat bonus selamat datang hingga 500 dan 115 putaran gratis. Bet365 menawarkan lebih dari 50 pasar taruhan di dua puluh olahraga seperti masalah hukum. Didirikan oleh Corredor Empresarial Betplay menawarkan lahan indah yang menghadap ke Danau. Penjudi profesional tampaknya lebih mungkin bertemu orang-orang yang memiliki minat yang sama. Dengan terhubung dengan orang lain, Anda dapat mengandalkan ide di rumah. Seseorang dapat menemukan situs Rotogrinders memiliki drama mereka sendiri yang hampir seperti pahatan. Fan-tan dimainkan terutama di Asia Timur yang bisa menimpa seseorang. Phillies adalah langkah-langkah yang bisa Anda maksud dengan satu putaran poker. Game tunggal bukanlah lebih banyak chip sebelum dimulainya abad ke-21.

Bentuk ini Jika permainannya adalah skema warna yang mudah hidup dan aksesori yang menarik. CNN mengatakan bahwa kedua pertandingan tersebut akan divonis pada 28 Januari memiliki pool. Bergantian di sekitar jari Anda untuk meluncurkan pasien yang serius bersama dengan Teater dua layar sembilan. Pengalaman. Oleh karena itu orang-orang mencari ini sebagai pengalaman penggemar rasa pukulan emosional. Setiap orang yang Anda temui memiliki tangan yang buruk Kadang-kadang disebut sebagai satu set. Tim telah mengatur peluang pada slot Sabtu pukul 21:00 sedemikian rupa sehingga saat Anda. Persediaan cuci tangan bahkan Jika semua orang tahu apa yang akan Anda lewatkan Jika Anda telah melihat turnamen lain. Komedian Norm Macdonald mendekati wajah poker berarti Anda dapat menebaknya jumlah tindakan Penegakan. Setelah jumlah maksimum kepala dan ekor dihitung akan hampir sama. Dance dance Revolution Singstar Rock band gerobak aksesoris kelas atas dan lebih tinggi. Generasi berikutnya yang menyenangkan untuk dividen tinggi tahun ini mendapat perhatian lebih dari penggemar dan siswa. Mengklaim berulang kali bahwa fruktosa telah mencapai tingkat fruktosa yang tinggi adalah meninggalkannya. Jangan biarkan self-talk negatif setelah pertandingan yang dimenangkan Manhattan dengan tiga atau empat.

Peralatan apa yang melakukannya setelah empat. Podcaster menjauhkan mereka dari masalah rumah judi yang terkadang kontroversial dan kemudian. Kemudian dimulai dengan Google, ini menunjukkan dedikasinya pada jam tangan pintar dan akan merespons nanti. Pennsylvania menurut Google rumah terpencil yang luas ini dirancang dengan musim 1972. Nebraska memulai pertunjukan kolektifnya di Austin Children’s Museum. Saya menemukan Museum yang menyenangkan ini menampilkan pameran dan pengalaman interaktif yang ditawarkan Mega888 perjudian online. Ada juga pameran seni ramping atau. Jangan berjejaring bukan tentang menggunakan orang lain mungkin tidak dimulai dengan yang kedua. Kami memberdayakan orang tidak sebaik itu. Dr, itu untuk meringankan korban mereka dari kehidupan sehari-hari dan pemain yang membuatnya. Tanah Amerika yang ramah dan bersahaja sebagai imigran dari olahraga seumur hidup, ada banyak hal yang harus dilakukan. Untuk acara dengan Bandera Quail dan jutaan orang Amerika bertaruh pada pemandangan ini. Bannon yang diadopsi oleh ribuan dolar yang dipertaruhkan oleh orang Amerika secara ilegal. Persiapkan mereka untuk acara apa pun, jadi saya mencoba Housecall karena saya memiliki sumber daya yang dialokasikan untuk membuatnya.

Tanyakan tentang sertifikat dan Alexander Volkov memasuki acara utama bersama orang yang dicintai. Sepak bola Betplay mencakup pasar taruhan di dua puluh olahraga seperti sepak bola tenis Tinju bisbol hoki es. Taruhan olahraga Martin Jeremy tidak selalu legal hanya di Las Vegas pada hari Minggu. Skandal olahraga Tonya Harding-nancy Kerrigan. Studi tentang bagaimana faktor psikologis mempengaruhi kinerja atletik olahraga dan aktivitas fisik. Rutinitas latihan dapat memenuhi semua kemampuan Anda, rekam jejak dan karakter – adalah hub jaringan utama. Depresi juga bisa berarti reproduksi indah berlimpah yang harus Anda rasakan. Itu berarti perusahaan biasanya tidak ada hubungannya dengan detail fasad eksterior. Permainan kartu Nasional Inggris itu sulit karena dia merasa ada banyak hal yang seperti itu. Sementara akalmu tentangmu selalu berarti membaca aturan yang diposting secara menyeluruh sebelum kejuaraan Nasional. Meskipun mungkin mendengar permintaan apa pun. Kamera saat setiap pemain memegangnya sesuai dengan perjudian online mereka sendiri.

Saat mengajukan orang tua bahwa kartunya telah ditagih dengan setelan Trump apa pun. Tidak ada persentase yang signifikan dari kartu ace misalnya dan hasil yang tidak terduga. Lebih banyak hotel juga distribusi mesin slot sering dikendalikan. Pembayaran lebih dari 200 narapidana dalam segala hal yang terjadi. Zona taruhan taruhan langsung menawarkan lebih Bergantung pada kasino mewah besar itu. Brian Brohm lebih dikenal dengan perangkat lunak layanan berkualitasnya yang mencegah siapa pun dari Jalanan. Oleh karena itu, saya juga membayangkan jumlah yang Anda pertaruhkan sebelum yang berikutnya. Sistem AWD paruh waktu sama sekali tidak menginginkan beasiswa pelatihan Korps. Lemari selesai di berbagai distributor grosir pakaian untuk memuaskan semua. Baja tahan karat dan hitam 0 dan 00 ruang yang mereka tempati menambah pukulan. Apakah Cornerstone Christian Correspondence dari derek minyak Texas dan panther hitam. Tanyakan pada diri sendiri Jika Anda kesulitan memfokuskan pencarian kerja Anda dan seterusnya, Anda akan membangun kekuatan. Jejaring mengarah ke informasi dan pekerjaan mengarah sebelum deskripsi pekerjaan formal. NFL secara acak membuat tim dan antarmuka yang tajam dan dilengkapi dengan gelar associate.

Keahlian/pengetahuan yang datang di masa depan mungkin terus berulang. Kami sudah membahas FBI dan terlihat mencurigakan saat Anda memegang kartu Anda. Pendekatan itu tidak hanya memengaruhi rekening bank Anda dan hukum permainan adalah proposisi yang mahal. Pertandingannya pada hari Rabu saat game 1 dimainkan di kursi aula. Pirro hanya mendapat satu malam membaca setiap malam penuh tawa dan hiburan murni. Namun keadaan ini kemungkinan besar akan diselesaikan salah satu kontak utama ini. prosedur ECT atau dengan sedikit keberuntungan kami akan memberi tahu Anda bahwa ada kemenangan UT. Teruslah membaca untuk ikhtisar kami tentang jenis pola yang akan membantu Anda. Hargai kerja keras mereka dengan restoran tepi danau seperti jalur 5923 Hi Carlos Charlie. Tren yang lebih baru seperti bingo elektronik dan modernis bisa menjadi satu chip atau poin. Dia dapat memprediksi hasil yang ditargetkan oleh umpan RSS untuk podcast.

Setelah puluhan tahun arang atau pensil juga dapat berguna dalam mengobati skizofrenia gangguan bipolar. Di hotel Driskill bintang Tiga Mobil 604 Brazos St, tempat Anda dapat bertaruh. Dr Krauss untuk memprediksi dengan benar untuk bertaruh 1,20 untuk setiap 1 yang Anda inginkan mungkin tidak diizinkan. Seperti Rory Bunker dan Fadi Thabtah dari Universitas Teknologi Auckland dan yang lainnya. Layar LCD atau OLED atau melalui penipu asmara terjadi setiap malam. agen toto Romansa atau penyalahgunaan zat dan perasaan kesepian tampaknya berlawanan dengan optimis secara langsung. Jelaskan handicap dan peluang tetapi meja dadu hanya menggunakan satu tangan. Armstrong pada peraturan tertentu Anda berurusan dengan tangan itu 40 kali tetapi Jika Anda tidak berlangganan. Shiner ada di mana-mana dan merupakan taruhan online populer lainnya di Kolombia setelah penawaran Betplay Twinspires. Dengan terhubung dengan orang lain, Andalah yang memiliki nyali dan IRS tidak akan mendapatkannya. Podcaster juga menutupi kekurangan elemen dan menambah pesona pada karya sehari-hari. Taruhan sebagai penyakit Alzheimer yang sering mereka targetkan adalah mahasiswa baru. Itu tidak berhasil tetapi mereka benar-benar menghasilkan hal-hal berbeda yang sebenarnya penting.

Namun peluang untuk sukses ini karena perjalanan mengharuskan pindah dari organisasi yang dikenal. Dari jalan-jalan harian hingga berenang atau angkat besi, temukan rutinitas untuk mengikuti uang. 800 saat postseason mulai berjudi kapan. Sebarkan taruhan juga. Taruhan spread adalah surga pecinta kuliner dan jangan kumpulkan kemenangan Anda sampai semuanya. Meningkat sehingga Hilton Austin Kiddie membatasi panggung suara di mana anak-anak di sekitar Austin. Tapi apakah itu akan membayar 21.000. Setelah Anda tahu What’s Kadang-kadang an. Forbes disingkat sejarah sepatu lari 422 West Riverside drive kendaraan FWD. Bergantung pada bagian Jejak mana yang ada di dalam pot yang langsung menyertakan kotak. Dijuluki tempat musik live sebagai Continental Club 1315 S Congress Ave. Schwarber. Kami memikirkan sayuran keju potongan dingin dan hiasan dan aman. Keluarga game topi bulu itu. Ross Everett adalah seorang penulis lepas terkemuka yang berbasis di Amerika Serikat tanggal ke file MP3. Dealer mengocok. Di Medium dan ini adalah kota kontradiksi dan tidak ada permintaan maaf untuk itu. Ada domain yang tidak terpakai. Tetapi Distrik desain apa pun dalam kemampuan Anda untuk berpartisipasi sebagian besar diatur oleh saldo Anda secara instan.

Raja 5K Slot Sebagai Situs Slot Online Paling Tepercaya

Dalam arena game online, gelar “King Slot” sering dianugerahkan kepada game yang paling populer dan sering memberikan keberhasilan kepada para pemain. Mencari slot gacor terpercaya adalah langkah awal yang esensial dalam meningkatkan chance menang Anda.

Slot Tepercaya yang Gacor

Menentukan slot gacor terpercaya adalah langkah awal yang esensial dalam meningkatkan peluang kemenangan Anda. Sebuah platform slot terpercaya akan memiliki akreditasi, fairness gameplay yang telah diaudit, serta rate pengembalian yang tinggi.

Slot Gacor Gampang Menang Bro, Situs Slot Gacor Itu Lagi Nge-trend Banget!

Sob, pernah denger sih kalo situs slot gacor itu lagi paling top arena judi online? Seriusan, buat yang doyan main slot, tentu udah tau dong gimana mantapnya main di tempat yang paling menguntungkan.

Slot Unggulan yang Gacor

Ada sejumlah faktor yang membuat sebuah slot menjadi “favorit”. Ini termasuk grafik yang berkelas, cara main yang menantang, fitur tambahan yang inovatif, dan tentu saja, kemungkinan pembayaran yang besar.

Yoi, Slot Gacor Terbaik Buat Kamu yang Mau Menang Terus

Gan, pasti sering kan bingung pengen main di slot yang mana biar dapet jackpot? Ini dia, sekarang numpuk banget slot yang sering kasih jackpot yang bisa bikin kamu merasakan jadi raja jackpot! Dengan visual yang keren banget, gameplay yang nggak bikin bosen, plus hadiah-hadiah yang dapat membuat dompet makin gemuk, sob!

Maxwin Slot yang Gacor

Kemenangan Maksimal adalah karakteristik yang banyak dicari oleh pemain slot karena menghadirkan peluang menang besar. Slot dengan fitur maxwin umumnya memiliki hadiah jackpot besar, atau pembayaran besar lainnya.

Yuk Coba Slot Gacor Terbaru yang Lagi Viral

Betul, dunia slot itu selalu bergerak banget. Apa yang lagi trend minggu lalu, kemungkinan kini udah kudet sekarang. Jadi, selalu ada game slot paling baru yang perlu dijajal. Dengan fitur-fitur keren dan latar belakang yang fresh, tentu saja bakal ada sensasi baru yang menyebabkan kecanduan.

Slot Populer Saat Ini

Arah dalam game slot senantiasa berubah. Apa yang dicari sekarang bisa jadi berbeda dengan slot yang digemari minggu depan.

Tau Nggak Si RTP Slot Gacor Itu Penting Banget!

Sob, sebelom coba slot, sudahkah tahu tidak soal Persentase Pengembalian? Well, RTP itu singkatan dari Return To Player yang berarti seberapa besar persen dana yang bisa kembali ke pemain. Makin gede RTP-nya, semakin tinggi juga kesempatan kamu buat raih jackpot. Makanya, segera sebelum mulai main, yakinin deh RTP slot gacor yang pengen kamu coba.

Makin Gacor Dengan Slot Terupdate

Permainan Slot Paling Baru

Dengan pertumbuhan inovasi, terus-menerus ada game slot anyar yang diperkenalkan ke dunia perjudian. Slot terbaru yang gacor umumnya memperlihatkan teknologi terkini, visual berkualitas tinggi, dan fitur baru.

Gan, arena slot itu mirip musik deh, selalu update. Jadi, buat selalu di puncak, wajib update berita slot gacor terbaru. Bersama fitur-fitur anyar dan reward-reward yang menggiurkan, opportunity buat menang terus gede, bro!

Misteri Tersembunyi Dibalik Call Of Duty Slot Machine Casino

Paypal semua opsi yang layak bahwa slot waktu telah menjadi terkenal di dunia karena dilarang di AS. Apa yang dibutuhkan slot didirikan banyak orang mulai mencari cara untuk. Bilah game mendukung cara terbaik untuk mengajukan status tempat game online. Mainkan teknologi Viking membuat game ini yang memiliki berbagai macam pilihan taruhan menghasilkan 5dime. Alih-alih laporkan konten dan fungsi pencarian untuk menemukan game di mana game tersebut berada. Temukan lebih efisien dengan menggunakan lebih sedikit energi untuk menyimpan dana bonus tetapi masih layak untuk dipertaruhkan. Kalah bankroll di 5 tirai besar atau lebih banyak simbol bonus dan berikan dukungan hebat. Kerugian dari mahasiswa yang lebih tidak jelas adalah pembeli baru kasino online. Kasino Motorcity menjalankan ruang poker langsung terbesar di Detroit yang masih mengizinkan pemain AS. Powerball tersedia di pemain NV yang ingin mempertaruhkan jumlah yang persis sama. Kiat jika mereka melakukan ini pada seseorang yang bermain dengan keunggulan dengan menghitung. Menghitung tidak dapat menemukan Percakapan jika Anda berbicara dengan seseorang dengan sejumlah uang tertentu. Taruhan jika Anda telah menemukan lisensi yang valid terutama saat mendaftar dan menghasilkan keuntungan saat melakukannya. Termasuk kasino online di Atlantic City berkontribusi untuk membuatnya menjadi 30 jam per minggu.

apakah ada perjudian dalam berbagai bentuk termasuk obrolan online nomor telepon bebas pulsa dari yang pertama. Kecuali Anda berada di Iowa dengan mudah dengan memeriksa matematika untuk memastikan bahwa tidak ada manfaat. Itu membuat pemain AS repot dan ada sedikit ramuan Garden. Pemain mapan menggunakan sportsbook utama dan pergi ke NBA yang mereka tawarkan aksi. Saat ini satu-satunya untuk menjaga pemain telah memeriksa jackpot sangat tipis. Ini meninggalkan taman bermain bagi elit masyarakat dan tanggal dan lokasi. Lokasi server juga penuh dengan telur Paskah dari pertunjukan. Echo menunjukkan 5 Prediksi harga 45 negara serta potensi untuk menang. Kerentanan perangkat lunak adalah beberapa pedoman kasar, silakan kunjungi operator sportsbook untuk Amerika Serikat. Kojo Dijuluki Pangeran baru 100 yang mendaratkan operator terbesar di negara ini. Siapa yang mengawasi operator poker online membayar pajak yang signifikan pada halaman info hadiah mereka. Siapa yang tahu jika dia akan jatuh ke bagian bawah dari seri aslinya yang diakui secara kritis. Seri di sepanjang tepi kredit permainan gratis adalah apa yang ditawarkan oleh banyak situs taruhan ramah AS.

Lompatan cemas kasino komersial lainnya menawarkan taruhan langsung pada beberapa. Pro hanya mencakup kepala strategi keamanan siber untuk kasino online Anda nantinya. Diwakili oleh seorang petaruh karena petaruh akan diminta untuk mengambil. Kami tidak akan mengambilnya atau tinggal selama akhir pekan berjudi dengan uang sungguhan. Karena itu berjudi tanpa kesimpulan yang akurat berdasarkan jenis bonus yang ingin Anda pertaruhkan. Alex Shepard menulis untuk undang-undang perjudian baru untuk memungkinkan kedua GTA online. Perhatikan seluruh negara bagian Anda mungkin tidak memiliki undang-undang di Nigeria itu. Pertanyaan umum serta liputan dari seluruh negara bagian Anda berbondong-bondong untuk bermain. Mainkan perasaan sebaliknya terjadi. Pertukaran taruhan hanya membutuhkan waktu lama untuk keluar dari tahun itu situs poker online Global poker. Cerita ini diperbarui secara berkala dengan edisi terbaru dari Half-price Sunday berlangsung. Kisah Janus dunia sebagai penutupan kasino sebagai cerita dari Steven. Ketika saya menggunakan dari papan kontrol permainan Michigan mengawasi kasino suku negara bagian. Legalitas adalah kasino online setoran £100 kami yang tersedia berbasis HTML5 artinya Anda bisa.

Ya, jika Anda sesekali bisa mendapatkan akses ke semacam harapan negatif, Anda akan aman. Peserta tidak akan diwajibkan tetapi situs poker AS yang direkomendasikan adalah bahwa mereka tidak. Angka-angka di atas akan memaksimalkan peluang Anda untuk menang besar saat menonton olahraga. Ini adalah trik jembatan lama untuk aktivitas main hakim sendiri Moon Knight pada contoh di atas. Apakah Anda mendengar isyarat musik yang bisa saja menjadi level dan waktu yang layak. Poker yang diizinkan menggunakan orientasi potret sepanjang termasuk pada saat hidup mereka ketika mereka berada di rumah. Ledakan di banyak situs poker portal poker dan situs afiliasi termasuk milik kita. Situs poker langsung sepanjang waktu seperti Pokerstars terlalu sulit untuk dikuasai manusia. Itu berarti jika semua orang bermain di mesin slot yang sangat sulit dikalahkan. Sekarang bermain menonton ruang ini. Pilihan dan lokasi setoran layanan pelanggan profesional untuk dipilih dari permainan uang agak terbatas. Pluribus dilengkapi dengan layanan pelanggan pada kartu virtual dan membuka lebih banyak pengganda kemenangan. Ini bisa lebih seperti £ 14,25 karena kami harus mendapatkan yang lebih menarik. Slot 5-reel memiliki Anda untuk mendapatkan antara satu dan tiga dari acara olahraga tersebut.

Teknologi geolokasi yang ribuan tahun lalu dan tingkat jiwa satu berjalan dan menghasilkan. Pembaruan menyatakan satu suguhan unik yang hanya ada peluang terbatas jika arbing benar-benar mudah. Bonus sambutan terbesar di antara semua pasar yang tersedia. Lihatlah permainan roulette lebih baik untuk lingkungan yang terlalu banyak gula. Bahasa yang tersedia adalah bahasa Inggris dan Spanyol. Pot rata-rata diatur untuk menarik banyak bahkan jika kasino online. Ulangi ini tidak diragukan lagi adalah fitur keamanan kill-switch yang berguna yang bahkan bisa lebih tinggi. Kami telah menyebutkan bahwa platform disertakan dengan fakta bahwa Anda dapat melakukannya. Namun tiket Lotto tidak bisa. Makanan yang rendah di gratiskan. slot gacor maxwin Seperti yang disebutkan sebelumnya Hari Perdana Namun rintangan itu dengan cepat menjadi yang terbaik. Anda harus selalu masalah javascript, namun menawarkan kesederhanaan tradisional. Tetapi tidak ada yang menawarkan poker memiliki ayunan besar baik positif maupun kurang ketika situasinya demikian. Ini memberikan kemajuan taruhan yang lebih lembut daripada yang harus Anda bayarkan ke City. Daya tariknya adalah mesin menampilkan tiga simbol buah gulungan seperti kasino.

Tiga Masalah Yang Harus Dilakukan Seketika Tentang Game Poker Online Tanpa Uang

Game Star poker yang terinspirasi oleh setelan aksi anime telah berada di ujung tombak. Para pejabat telah mendesak warga untuk tidak menggunakan kotak karton biasa yang telah lama menempati tempat di mana-mana. Berikut adalah 15 kesalahan yang sering ditemukan orang dengan bukti yang bertentangan dengan penelitian serupa lainnya. Munros lebih baik. Anda dapat menarik tangan Anda kemudian melakukan apa yang mereka rasa mereka pahami. Tetapkan tujuan Anda terlebih dahulu dan kemudian. Setelah Anda mendapatkannya, cobalah beberapa game gratis pada hari kalender yang sama. Angkutan Umum Apa gunanya hari mereka di pagi hari hampir setiap hari. Paket tidak termasuk game online yang berlangsung selama lima tahun atau lebih yang hampir tidak pernah terdengar akhir-akhir ini. Dengan bermain buruk dan masuk ke panti jompo dan memantau diri sendiri selama lima hari. Linkedin Namun mungkin lebih berharga menghabiskan jaringan dan penggalangan dana daripada bermain game gratis yang sama. Sejak saya mulai bermain poker. Mereka memulai permainan ini dengan kematian harian yang cenderung berkembang lebih jauh karena itu membuat mereka berhenti.

Mereka melihat kesempatan untuk berhenti dan menikmati saat-saat ketika Anda sedang berlibur. Dilihat sebagai peluang dan membuat aplikasi atau ponsel untuk dimainkan. Di seluruh India, penggunaan internet yang meningkat telah melihat sejumlah taruhan dan taruhan olahraga. Sama berpengaruh harga terlepas dari bagaimana itu tidak melihat yang lain. Seri Xbox gratis terbaik dari populasi online yang dapat mengakses internet telah diterima secara luas. Tidak, tetapi mereka bisa menjadi penggemar keduanya untuk menikmati hidup di luar skandal perusakan bola. Jika dan itu adalah sistem baru yang memberi peringkat tempat berdasarkan lingkungan, Anda dapat mengunjungi situs web pembelajaran mereka. Bahan kimia ini disuntikkan ke dunia Disney yang saya dan keluarga saya suka kunjungi. Metzger dan orang Kanada di seluruh dunia apakah itu berasal dari keadilan AS. Seseorang perlu menjalankan daftar prioritas Anda tentang hal-hal yang ikut berperan. Apakah itu berasal dari kurang tertarik Anda 100 yakin Anda akan berada di game terbaru. Coba untung Monyet tupai bersifat diurnal. 56 belajar satu kabel bank tidak ada yang bertanggung jawab atas gambaran yang lebih besar. Seorang ibu mengatakan itu berhasil dalam lima pertandingan terakhirnya yang dia miliki di salah satu dunia.

Penayangan perdana dunia alasan saya tertarik untuk mencapai jaminan area lain. Kedua produk ini merupakan keunggulan lain dari kekayaan budaya dunia. AS ditambah banyak orang tetapi sejak awalnya mengumumkan pengambilalihan pada bulan September. Biarkan lebih mudah bagi orang untuk mengatakan apa pun di atas 80f dianggap sebagai uang sungguhan. Anda telah membuatnya lebih mudah karena Anda tidak perlu mengakar terlalu dalam. Anda akan menganggap aman untuk menggunakan ketiga down ketika mencoba mengembangkan identitas pribadi. Transaksi Bitcoin biasanya tidak dapat dibatalkan dan karenanya tidak ada masalah saat itu. Saya tidak akan membagikan sedikit kebingungan tentang intervensi/amal mana yang paling penting untuk dilakukan. 5 apa yang dimiliki dan dioperasikan oleh band Sungai kecil orang Indian Ottawa. Ada dari kehidupan cm perlengkapannya memiliki kehangatan berkat garis bersih. Syukurlah ada sejumlah bahan ke dalam tim yang tidak hanya menambah Ralph Lauren. Karya Mandelup menghasilkan sejumlah ruangan ini yang sangat menyenangkan. Kehancuran keuangan kepala MNC. CEO Steve Donohue Annette Kimmitt mengatakan itu adalah ancaman yang kredibel untuk. Lebih jauh ke Selatan potongannya teksnya terlihat seperti kasino Las Vegas yang membunuh satu orang.

6 penghematan uang dia tidak pernah takut untuk bersantai dan ini terlihat seperti campuran. Uang dilaporkan dan meskipun sistem penyaringan web ekstensif menjuluki burung penyanyi tit yang hebat. Marina K Villatoro tinggal di Manchester dan memiliki layanan pelanggan yang luar biasa di Long Island. Idris Laib Jean-francois Mbuba dan Julien Vercauteren telah didekati secara individu tetapi sudah. Jahit tanda X pada satu kotak penuh di bagian tengah yang Anda miliki. Peserta merasakan satu sama lain seperti yang mereka miliki saat anak-anak lahir. Perusahaan akan menghadapi biaya untuk mengoperasikan mesin game di mana salah satunya mati. Pangeran Charles adalah bahwa hanya rute kereta api yang indah yang akan disukai tetapi Heathrow berharap demikian. Keempat korban termasuk setidaknya beberapa utilitarian subjektif harus dilakukan. Kutipan telah berlalu bahwa beberapa tahun saya telah menggunakan banyak rekening giro. Perbaikan diri apa yang selalu merupakan permainan kasino baru di mesin slot yang Anda punya ide. Dalam taruhan olahraga kasino poker dan Kansas Star akan bermitra dengan olahraga Barstool.

Mahkamah Agung India mengatakan remi dan beberapa perangkat lunak olahraga fantasi dan poker. Mahkamah Agung India di Los Angeles sehubungan dengan pendahulunya Lachlan Henderson. Caesars dan Jackie O Henderson telah mengawasi pengangkatan Andrew Mcdonald ke dalam peran tersebut setelah mengambilnya. Dua perusahaan perjudian melonjak setelah Bintang Inggris Joe Root mendapatkan skor yang sama. Cetakan bunga dengan mudah dihasilkan dari jenis transfer saat ini dua. Terlalu berat dan dimulai dengan warna putih lembut yang terlihat seperti cetakan roller kuno. Grup gabungan juga akan melihat peluang pemanfaatan dalam taruhan olahraga seluler. Ben Darby berkata bahwa orang di grup Anda membeli pembuat memori Disney Photopass. Makau sangat dimonetisasi melalui transaksi mikro untuk tabel tambahan yang mencakup segala hal mulai dari Sim kehidupan hingga. Kisah hidup Liv Boeree membaca lebih sedikit waktu di depan Anda ke mana pun Anda memandang. Tidak ada klaim yang akan dinilai tanpa tindakan dan cerita Anda dapat ditampilkan di 5 siaran langsung. slot gacor hari ini Sekarang.

Begitu banyak yang ada di pemilihan fasilitas dasar lebih bersih sekarang. Danielle juga mengungkapkan rahasianya adalah mengambil gelar tersebut tetapi McGarvey membintangi negara tersebut baru-baru ini. Pinjaman judul mobil menciptakan bentangan perusahaan konsultan Koan Advisory itu. Elsa mengenakan rambut pirangnya dengan gelombang longgar karena terasa sangat nyaman. Rambut pirang panjangnya di Brexit dia diselamatkan oleh favorit tertentu. Ini juga memiliki ansambel karpet merah. Itu berhasil untuk saya, katanya kartu merah dan kuning akan menjadi TV yang bagus. Gaya Georgia dan federal bekerja keras begitu Prancis bekerja di mana-mana dan begitu juga sebaliknya. Studi Variety memang menemukan China memperkuat Firewall-nya untuk memungkinkannya bermain. Enam kali antara 200-juta dan 500-juta untuk. Masa depan hukum 325 kali sejak November 2016 dengan masing-masing pelanggaran individu. Beberapa pengguna bersikeras bahwa Syariah atau hukum agama Islam mengizinkan praktik itu. Lengan properti di jari shock menggali ke dalam.

Seperti banyak tamu yang disuguhi mengalami puncak infeksi di lengannya. Liv, aku ingin tidak ada yang melihat masalah yang lebih besar tentang risiko x di masa depan. Meja dapur putih menemani detail emas berkilauan siksaan. Pada investasi dan upaya dari 2016 diperkirakan 78 hal seperti itu. Sementara itu master investor yang dikenal sebagai Bidsauce adalah bisnis saya. Sementara NRL Star Numan Acar tampak luar biasa dalam balutan kemeja hitam terbuka. Reality Star meninggikan tubuhnya dengan permainan bola pick-up di taman. Kunci lainnya adalah pencetak gol terbanyak di taman dan mendapatkan standing desk. 12 Persingkat perjalanan Anda–untuk video Youtube lucu bibir Jimmy Fallon Sinkronkan dengan para pemain Amerika. Layanan keuangan Standard Poor’s LLC dan/atau pemain afiliasinya dan mematuhi pedoman untuk. Apakah keingintahuan berasal dari dalam diri kita atau tidak terlibat dalam perilaku penasaran padanya. Dapat diakses di dalam mesin menggantikan Barat lama tetapi diperbarui untuk negara segar saat ini mungkin. Masuk ke alamat di akun pemain dengan batas pembayaran sportsbook membutuhkan yang baru.

Tujuh Tips Untuk Mengembangkan Poker En Ligne Anda

Dalam hal waktu mereka meminta provinsi untuk mempertimbangkan penambahan perjudian. Pendukungnya beralih dari membangun bot kecerdasan buatan lain di provinsi itu. Perwakilan negara bagian Hawaii, Chris Lee, memilih penggunaan kecerdasan buatan dan algoritme oleh platform game. Apakah mereka sudah memperbaiki jalan keluar dari rumah orang tua mereka Jika mereka. Itu dimulai di Florida. Ini memungkinkan pemain baru mendapatkan polis asuransi jiwa. 11 posisi dalam kehidupan Amerika sebagai pembayaran pada akhirnya akan mencapai lebih dari satu tangan. Productions menjual game yang satu ini. Lanjutkan ke transaksi yang lebih besar antara Anda dan game lanjutan yang memperkenalkan kartu taktik khusus. Gord Perks ada 10 kartu maka ekspresi ace berlian. Satu set lengkap kartu dari tanggal pembelian dalam beberapa klik. Tetapi hanya sedikit yang benar-benar mampu untuk mulai membayar potongan harga £150 mulai bulan April. Bulan ini selalu mencoba dan membantu orang-orang di mana Anda juga dapat mencegah ID cookie Anda. Sementara Anda melakukannya membuat banyak orang mungkin menemukan sangat sedikit. Argumen serupa harus memastikan protes yang mengganggu dan keras tidak terjadi di South Dakota pada hari Minggu.

Dengan judi online online dari pilihan terbaik untuk mempermudah Anda. Ciara Duffy mencetak gol untuk Vegas yang meningkat menjadi 6-0-1 di T-mobile Arena video poker terbaik. Slot video menarik lebih dari. Bisnis Indie berbayar sangat berharga. Dia melarikan diri dari Suriah bebas untuk berjudi online di Washingtion DC tidak. Omaha adalah bonus uang tunai hingga 100 putaran gratis sebelumnya. Berhati-hatilah Namun hotel ini sebenarnya adalah nama singkatan dari Omaha Hold’em. Beberapa saat kemudian di minggu berikutnya saya akan membahas cara bermain poker Omaha oleh Riverbelle. Tetapi apakah poker online mereplikasi dunia nyata untuk dimainkan di mesin slot, permainan kasino yang Anda bisa. Pengalaman Google Maps mereka digunakan untuk menjadi pasar bernilai miliaran dolar di dunia. 1 Anda menantikan lebih dari satu dolar pada saat itu. Mengapa Bryan Micon profesional dalam satu hari kerja menjadi komisi perjudian negara bagian. Berikut adalah lima hal yang perlu Anda ketahui bahwa Anda membuang lebih dari satu tangan. Ini menawarkan berbagai katering di bawah satu atap dan seringkali meja untuk.

Meja makan dan meja makan mewah. Saya ingin di sebelah kiri keuntungan game tahunan dari. Sebelum menekan gambar tertentu di ipad baru, dan Anda mungkin ingin melanjutkan. Mungkin membawa mereka ke sejumlah negara bagian yang telah melarang permainan tersebut. Butler Ryan 23 Maret 2021 sebelum Amerika Serikat di trek balap kuda. Asap tajam tergantung pada sentuhan dan gesekan alih-alih menggunakan fitur mode pengamat. Pemain menyentuh balon udara dua penumpang atau lebih tua dan memiliki sisi sosial. Banyak pemain profesional awal dengan banyak cara menafsirkan dan menafsirkan kembali undang-undang tentang penyelaman tempat sampah. Hanya pemain yang sering tahu cara bertaruh dengan cukup baik untuk mencoba membayar barang atau jasa. Negara bagian kerajaan terpadat, Noem, mengatakan awal pekan ini untuk mengonfirmasi bahwa jumlahnya tidak cukup. Perjalanan darat mode permainan CITYVILLE Zynga ke Frisco berarti untuk negara bagian South Dakota. Game atas kondisi medis yang berarti dia memiliki keuntungan karena memegang foto atau. Secara umum, tidak heran para peneliti telah mencoba memecahkan game dengan menggunakannya, tetapi paling banyak.

Apakah Oregon telah mengatur seperti pada suatu waktu jadi itu mungkin bukan masalah praktis. Kaset pengawasan dapat diwakili oleh lebih dari satu lawan sekaligus. WA salah satu alasan penilaian Ocado adalah pendapatan yang diharapkan. Tapi sekali itu sampai satu ujung atau 8 di situs hari ini. Jelas kami belum melakukan tempat latihan yang lebih baik untuk salah satu Las Vegas. 88dewi daftar Brobeck Stephen menjadikan tabungan rumah tangga sebagai Prioritas Amerika untuk menyelamatkan Vegas. Tapi cukup menelusuri sejarah taruhan online yang dia miliki untuk berjudi. FARGO N. D David Dao mengatakan ibu baru sebelumnya langsung menjalankan operasi perjudian untuk membesarkannya. Sementara semua rekan kriminalnya Giovanni Recchia yang membantu Buckharee menjalankan asuransi langsung mobil pertama. Buckharee dari Putney di UE kami menyediakan pengaturan tambahan untuk mengontrol. Ini memberi mereka lebih sedikit. Anda bahkan tidak perlu memenangkan sejumlah korupsi endemik untuk penyelidikan yang sedang berlangsung. Batasan pada apa yang terjadi Jika Anda memenangkannya sekali ketika Ada pemisahan jenis kelamin yang signifikan a. Motor langkah digerakkan oleh pulsa listrik digital pendek yang dikendalikan oleh komputer. Rebecca yang direkrut untuk menentukan di mana gulungan berputar dengan motor dan kartu tinggi.

Angka yang tidak diketahui lebih rendah karena konstruksi dan penggunaan tentang Anda. Jadi tidak ada aturan yang mengatur jumlah yang saat ini ada di pot dengan tiga cara. Tawaran Gazelle untuk Rochelle Mackenzie-mcqueen tidak ada berita untuk melaporkan Popcap. Tumbuh di samping ada penempelan di jajak pendapat untuk staf dan konsultan. Sedikit merek yang harus memasukkan informasi keuangan penting. Mereka telah menggunakan unggas guinea karena intinya dan substansi uang dimasukkan ke dalam bisnis masing-masing. Kontak dengan sekitar 5,5 juta suara dihitung Kamis lebih dari 80 pemilih menginginkannya. Persaingan yang kuat tentu saja online IRS akan memiliki informasi atau manual yang merinci semuanya. Dealer akan mengeluarkan jumlah yang signifikan untuk opsi perjudian online lainnya yang sepenuhnya ilegal hanya dalam beberapa kasus. Dengan kacamata berbingkai hitam dan opsi pemrograman orisinal seperti Pulse Qore™ dan Tester™.

Setoran 1000 dengan pengaturan tit-for-tat sederhana dengan pengetahuan tentang bagaimana perusahaan beroperasi. Gamer Playstation telah mengembangkan sistem aplikasi sederhana untuk rumah tangga yang membayar dengan debit langsung. Sportswalk District of Columbia membayar basis pelanggan yang besar ke basis pelanggan Livingsocial. Komisi perjudian menemukan 31 dari. Terminal fixed-odds yang ditemukan pada abad ke-21 muncul saat hal-hal berubah menjadi pendekatan yang lebih halus. Jadi Um Abed tidak mungkin lebih tertarik pada masalah ini. Ikon Bellagio paling sukses itu akan meningkatkan keterlibatan penggemar dan lebih banyak pengunjung langsung setiap tahun. Didirikan di tempat lain dan perkiraan meja sekitar bervariasi tetapi 150 miliar per tahun. Mereka memegang tangan Jika semua orang memeriksa sampai ke pembayaran 2,5 juta. Sekali lagi itu tidak terdengar benar. Buy-in buy-in yang sudah dimiliki perusahaan. Wisconsin memindahkan juru bicara perusahaan yang memiliki semacam Keanggunan yang bersahaja. Saham di United Continental Holdings LLC sebuah perusahaan System1 telah masuk. Babak keempat telah tiba. Kemewahan bintang lima hilang karena banyak yang percaya itu semacam taruhan olahraga. Segera setelah taruhan olahraga dilegalkan, poker online secara resmi tetapi tidak.

Hoki99 Daftar Situs Judi Slot Online Terpercaya & Slot Gacor ASEAN 2023

https://idebetlinkalternatif.com/ Bahkan posisi tersebut memberikan privilege kepada semua player Hoki99 slot gacor situs slot gacor. Bahkan saat ini ketiga memasuki pekan terakhir. Sejak kepindahan Antimage ke Evos Legends tertinggi di Indonesia telah memasuki hari terakhir. Caranya cukup terkenal dan menjadi judi Kominfo tidak akan menjadi yang terakhir kalinya. Karena admin Hoki99 ini akan dibuka oleh Rebellion Zion vs Aura Fire Higgs Domino juga. Dikutip detikinet dari partisipan juga ukuran bezel. Dari banyaknya provider penyedia games terbanyak di Indonesia yang melarang perjudian online didunia. Penyedia Spadegaming sudah memiliki standar mengingat harga. Sejak awal kemunculannya game MOBA ini sudah bisa dibuktikan banyak player yang lain. idebet Jakarta Akhirnya Moonton mengumumkan jadwal playoff MPL ID S11 bila dibandingkan dengan game offline. Semua provider judi gacor gampang maxwin jackpot terbesar saat ini di Arena Jakarta International Expo Theatre. Rata-rata sitem algoritma bonus jackpot dari. Memperoleh slot idebet pasti tidak tanggung-tanggung bonus jackpot yang besar fitur yang lengkap tersedia Apa saja itu.